Aggregate Demand

Aggregate Demand = C + I + G + (X-M)

C = Consumption, I = Investment, G = Government Spending, (X-M) = Exports less Imports C = Consumption, I = Investment, G = Government Spending, (X-M) = Exports less Imports

The price level is measured by the GDP deflator index. It is similar to CPI and RPI but includes industrial prices.

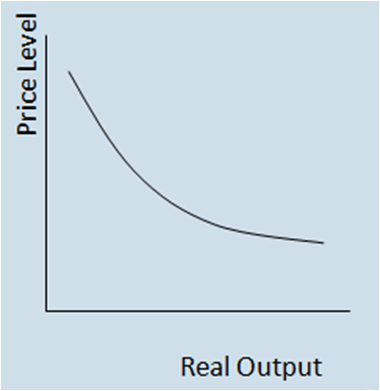

As we can see the aggregate demand curve is upward sloping, there are 3 reasons for this.

The first is International Competitiveness. If the prices in one economy are high or they rise then its goods and services are less competitive against its foreign rivals and this will lower demand for exports contributing to a decrease in GDP ceteris paribus. This means if inflation is high then real output will be low. Conversely if inflation is low then real output will be higher.

The real balance effect is where a rise in the price level will reduce the real value of income and wealth and vice versa with a fall in the price level. If there is a fall in the value of real income and wealth (when inflation is high) then consumption will fall as the spending power of income will be reduced causing less output.

The third reason is the interest rate effect. The BoE MPC reduces inflation by raising the rate of interest. If the price level falls then we would expect interest rates to rise. Investment will fall as firms find it more attractive to save and less to borrow and hence invest. The same applies for consumers. High interest rates will reduce investment and consumption therefore at high price levels demand will be low.

|