Buffer

Stock Schemes

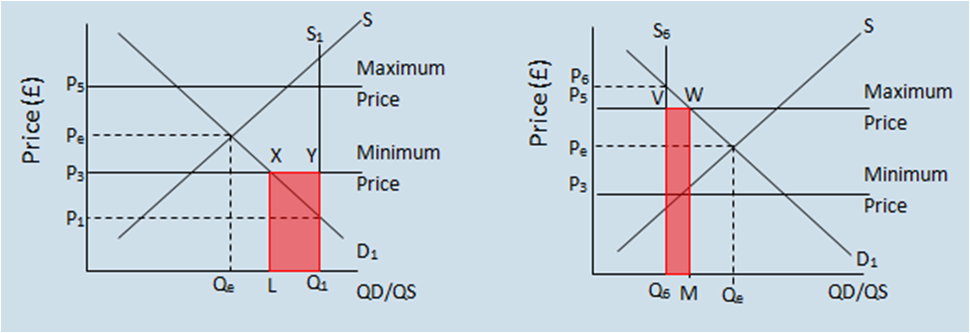

A buffer stock scheme may be operated by a government in

order to reduce price fluctuations of a commodity. It involves the government

setting a target price range for a commodity (a maximum and minimum price) and

intervening to ensure that the price remains within in this band despite

changes in supply and demand.

In times of an increase in supply the price may fall too low, so the government buys up the excess supply of the commodity and stockpiles it. In times of decreasing supply the price will rise and so the agency sells from the stockpile in order to reduce the price.

From the graph on the left we can see that there was an

increase in supply from Qe to Q1 which caused the price

to fall from Pe to P1 which leads to the government

intervening. The government purchases quantity XY in order to ensure the price

remains at P3 this costs them XYLQ1.

From the graph on the right we can see that there is a

decrease in supply to Q6 which causes the price to rise to P6

the government intervenes and sells quantity VW from its stockpile which causes

the price to fall to P5. The government revenue earned is VWMQ6

and leads to a reduction in the governments stockpile.

The scheme is intended to be self-financing since the

government purchases the stock at a low price and sells the stock at a high

price therefore paying for administration and storage costs.

Advantages

and Disadvantages of a Buffer Stock Scheme

Advantages include reduced commodity price fluctuations,

there is a greater certainty in the market leading to more investment. There is

also ensured provision of commodities for consumers even in years of poor

harvest.

Disadvantages include the costs for storage and security of

the stockpiles which leads to an opportunity cost as the government cant spend

money in other sectors. If supply continues to increase without disruption then

it will mean the government has to purchase more surplus stock and store which

may become more expensive. Conversely their may be an event which causes a

decrease in the supply which would mean the government has to use up its

stockpile, if this continues and the government runs out of stock then the

market price will eventually exceed the maximum price and so render the buffer

stock system inept. The price range may be inaccurately set in the first place

which would also cause problems. The stocks may be perishable over a long

period of time which means the government can lose money if it has to destroy

stock.

Page last updated on 20/10/13

|