Consumption

Consumption is the largest single component of AD (60% of

it). According to Keynes the most important determinant of spending by

households is disposable income. Therefore as real incomes rise, households

will tend to spend more. Keynes also pointed out that they wouldn’t spend all

of it but would save some. Keynes defined the average propensity to consume

(the proportion of income that households devote to consumption) as the ratio

of consumption to income. And the marginal propensity to consume (the

proportion of additional income devoted to consumption) as the proportion of an

increase in disposable income that households would devote to income.

However income isn’t the only influence on consumption as it

may also depend on the wealth of a household. Income and wealth aren’t the

same; income accrues during a period as a reward for the supply of factor

services (labour). On the other hand, wealth represents the stock of

accumulated past savings. If households experience an increase in the value of

their asset holdings (wealth) then this may influence their spending decisions.

If parts of household spending are financed by borrowing then

the rate of interest is significant in influencing the total amount of

consumption spending. An increase in the rate of interest may deter consumption

and vice versa. At the same time it may encourage saving. The rate of interest may

also have an indirect effect on consumption through its effect on the value of

asset holdings (wealth). Households may adjust their consumption based on their

expectations about inflation.

Some of these determinants aren’t instantaneous and so there is a time lag for consumption to adjust.

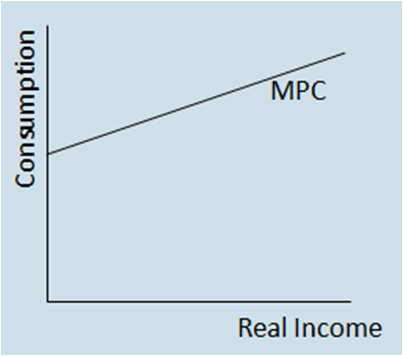

The consumption function is the relationship between consumption and disposable income. Its positions depends on other factors that affect how much households spend on consumption. The graph above shows the relationship between consumption and real income ceteris paribus (other determinants such as wealth and interest rate remain constant). The Marginal Propensity to Consume (MPC) is the line, if MPC was 0.7 then for every additional £100 of income received by households, £70 would be spent on consumption and £30 would be saved.

A non price factor that will lead to increased consumption is a Feel Good Factor or Consumer Confidence. If consumers are confident about the future (they believe that their real incomes will remain constant or will increase or they will receive a wealth boost perhaps through inheritance or a form of lottery) then consumption will increase, the same applies if there is a Feel Good Factor affecting them.

Consumption is considered an autonomous component as even when income levels are zero people will still spend on necessities such as food and shelter. They would finance this through depleting their savings or by borrowing.

The Effect

of House Prices on AD

For existing house owners if the price of houses falls then

they will see a negative wealth effect and will reduce their spending.

Confidence in this group will be low, and vice versa.

For new first time buyers a fall in house prices will be

positive as they have to borrow less and will have more disposable income after

paying their mortgages. Therefore consumption will increase, and vice versa.

The overall effect on consumption and on AD will depend upon

the relative strength of these 2 groups (whichever is larger).

Page last updated on 20/10/13

|