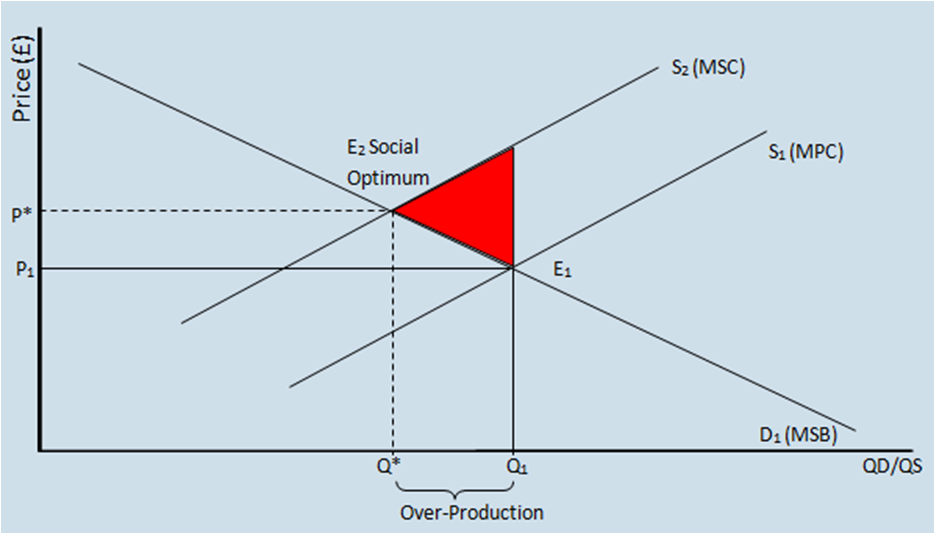

The Demand Curve (D1) shows the Marginal Social Benefit (MSB) since there is only one curve (for demand) we can assume that there are no externalities considered on the demand side (MSB = MPB). Q* and P* show the price and quantity at the social optimum.

The triangle shows the deadweight loss or welfare loss,

showing the MSC exceeding the MSB. The triangle grows the further out you go

from Q*. This is damage caused by production to a 3rd party in the

sense of an externality. For every point between Q* and Q1 (and

further) the marginal social cost exceeds the marginal social benefit. There is

a market failure as too many goods (Q1) are being produced at too

low a price (P1). The good/service is therefore usually

over-consumed.

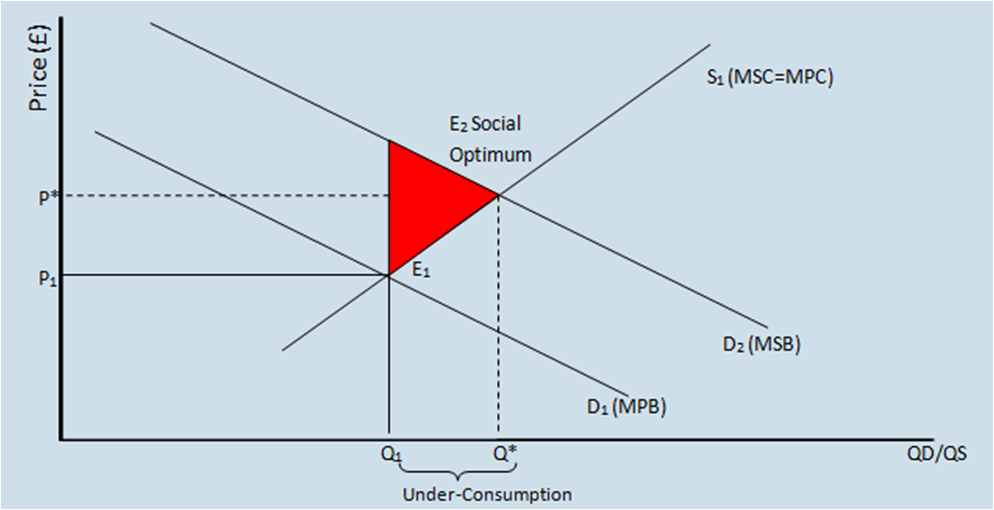

Positive

Consumption Externalities

Social

Benefit = Private Benefit + Externality

This is an externality that brings social benefit from the consumption. We can see from the graph that there are 2 demand curves; D1 the MPB (normal market demand curve) and D2 the MSB. There is only one Supply Curve (S1) so MPC = MSC (i.e. there is no externality considered). Q1 and P1 show the normal market price and quantity at E1 and Q* and P* show the price and quantity at the social optimum equilibrium point (E2).

The triangle shows the dead-weight cost. Assuming that the

example above shows the costs and benefits to a frontline health worker

considering whether or not to be vaccinated against flu and we can explain the

graph.

The externality is created because there are benefits to

society from the health worker consuming the vaccination, for example people

are less likely to be come ill. The marginal social benefit from vaccination is

more than the marginal private benefit. In a free market individuals decide for

or against the consumption of vaccinations by assessing the private benefit

they receive from it. Equilibrium occurs where MPB = MPC. Society would like Q*

to be consumed, where the MSB = MSC. For all units of output between Q1 and

Q*, MSB exceeds MSC, showing that there is a benefit to be gained from greater

consumption of vaccination. The shaded triangle shows the welfare loss to

society (the social benefit foregone) if Q1 is consumed instead of

Q*.

Allocative Efficiency occurs when marginal benefit is equal to marginal cost (MB = MC).

A general

explanation:

The graph shows an example of a positive/negative

consumption/production externality. The externality is created because there

are benefits/costs to society from the consumer/producer ... (doing what)...

for example ... The marginal social benefit from ... is more/less than the

marginal private benefit they receive from it. Market equilibrium occurs where

MPB = MPC. Society would like Q* to be consumed/produced, where the MSB = MSC.

For all units of output between Q1 and Q*, MSB is greater/less than

MSC, showing that there is a benefit to be gained from more/less

consumption/production of ... The shaded triangle shows the welfare loss to

society (the social benefit foregone) if Q1 is to be consumed

instead of Q*.

Dealing

with Externalities - Internalising Externalities

Externalities arise when the benefits or costs of a

transaction are not reflected in the market price. There will therefore be a

market failure as the free market will not lead to an optimum allocation of

resources. One way to solve this is to internalise the externality by bring the

cost or benefit into the price system.

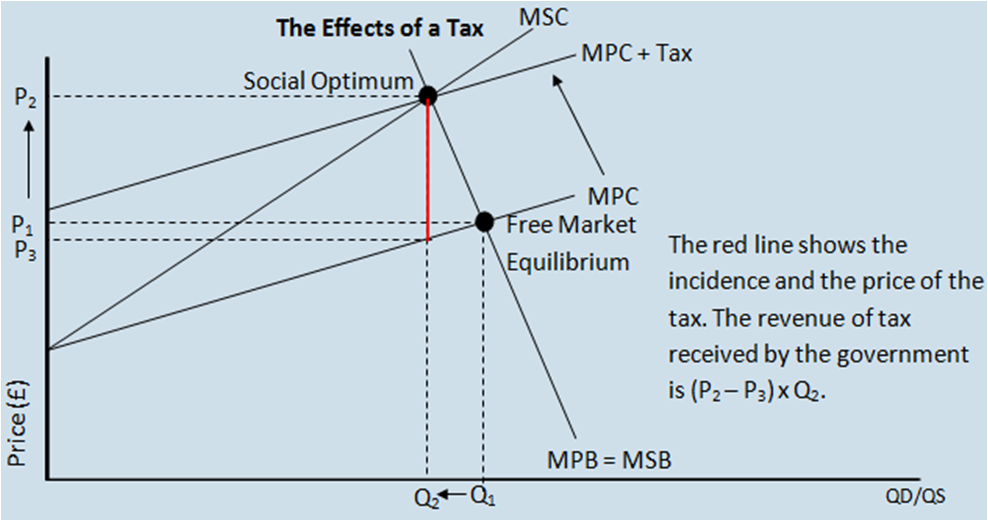

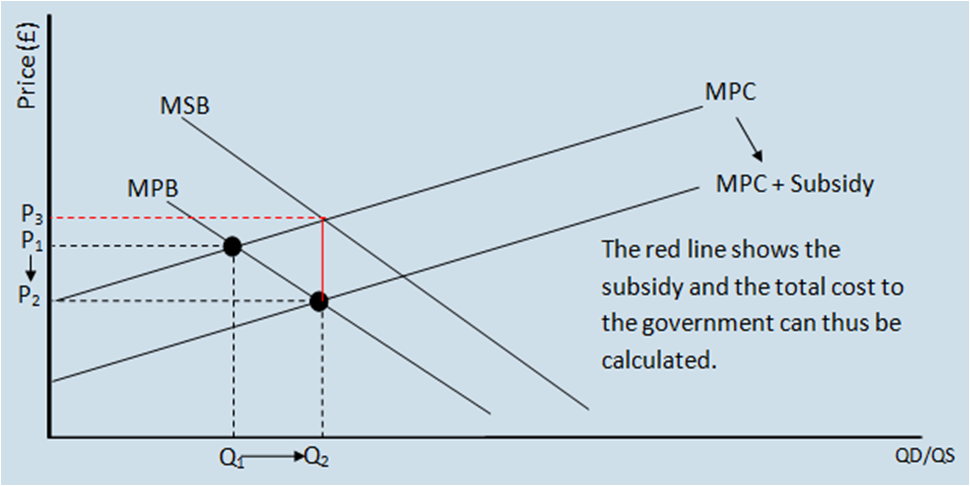

Taxation and Subsidies

Indirect taxation or subsidies can be used by the government to correct market failures. A tax would discourage consumption by increasing the price of the product (as the supplier would pass on some of the costs). A subsidy would encourage consumption by reducing the price of the product. This remedy would correct the market failure of externalities. A tax could be used to correct a negative production externality and would discourage the production of demerit goods. Conversely a subsidy would be used to correct a positive consumption externality and encourage the consumption of merit goods.

The Effects of a Subsidy

Advantages

and Disadvantages of Taxes

Tax funds can be used to compensate victims or can be used in

other government schemes, also taxes reduce the amount produced to the social

optimum point where less of the good/service are produced therefore being more

beneficial to society.

Disadvantages of taxes are that firms may relocate to other

countries with less stringent taxes, if the demand for a good or service is

price inelastic then the reduction in good/services wont be great, indirect

taxes make firms less internationally competitive, it might lead to the

development of illegal markets and also it is hard to determine what price to

tax the good or service at.

Advantages

and Disadvantages of Subsidies

The advantage is that they increase the consumption which is

generally considered beneficial (as goods that receive subsidies are usually

merit goods which are under-consumed).

The disadvantage is that there is an opportunity cost to the

government, it may lead to higher taxation or reduced government spending in

other sectors. Also firms may become inefficient in production if they rely

upon subsidies, and the firm may absorb the tax in the form of profits rather

than pass them on to consumers in the form of a price reduction.

Pollution

Permits

One method of reducing pollution is to use a pollution permit

system, under which the government issues or sells permits to firms, allowing

them to pollute up to a certain limit. These permits are then trade able so

that firms that are relatively clean in their production methods can sell their

polluting rights to other firms, whose production methods produce greater

levels of pollution.

Firms that pollute because of their relatively inefficient

production methods will find they are at a disadvantage because they face

higher costs. Rather than continuing to purchase permits, they will have an

incentive to produce less pollution. A second advantage is that the overall

level of pollution can be controlled by this system as the authorities control

the amount of permits that are issued.

However there are issues with the system, sanctions must be

in place for firms that pollute beyond the permitted level, and they must be

cost effective methods for the authorities to check for the level of emissions.

It is also hard to determine how many permits to issue and

the price at which to issue them in order to make sure the MPC equals the MSC.

Advantages

and Disadvantages of Pollution Permits

Advantages include governments being able raise funds which

they can use to compensate victims, firms have an incentive to invest in clean

technology and clean firms receive a source of revenue as they can sell their

excess pollution permits.

Disadvantages include issuing too many or too few permits,

reducing the international competitiveness of firms, leading to some firms

relocating outside an area participating in a permit scheme. Some firms may

pass the costs of pollution permits onto customers therefore increasing the

price for consumers (although this is only likely to happen if the product is

demand inelastic). Also as the price of the permits fluctuate it is difficult

for a firm to determine whether or not to invest in cleaner production methods,

there is a cost to the government to monitor the scheme and unless all

countries participate in a pollution reducing scheme it is unlikely that global

warming will abate.

Property

Rights

The existence of a system of secure property rights is

essential for the economy. The legal system exists to enforce property rights

and to provide the set of rules under which markets operate. When property

rights fail, there is a failure of markets.

One of the reasons that some externalities exist is because

there is a failing in the system of property rights. For example if a firm

pollutes toxic fumes into a residential area then there is an externality, if

the residents could be given property rights over clean air, they could get

compensation from the firm. This would act as an incentive for the firm to

reduce pollution and would also compensate the residents. However with such a

wide range of people being affected it is impossible to practically assign

property right.

Property rights can be effective in curbing the effects of

externalities only if the costs of implementing it are not too high.

Advantages

and Disadvantages of Property Rights

Advantages include more sustainable management as the good

that is being exploited now belongs to someone, and they will want to keep it

for the use of future generations.

Disadvantages include it being difficult for a government to

extend property rights as they don’t know who the property should belong to,

who to give the property to if it spans more than one country and it is

difficult to place a monetary value on the use of a property right.

Government

Regulation

There are various forms of government regulation to correct

market failure. These can include imposing fines or closing down firms that

don’t abide by strict rules regarding environmental and ethical issues.

Advantages

and Disadvantages of Government Regulation

Advantages include reducing the problem of asymmetric

information, raising money for the government from fines and for the rules

being simple to understand.

Disadvantages include it being expensive to monitor and it

being hard to put a monetary value on breaking the regulations.

Page last updated on 20/10/13

|