Inflation

Inflation is defined as a change in the overall level of prices in an economy. The first step in measuring inflation is to measure the average level of prices in the economy. Inflation is then calculated as the percentage rate of the change of prices over time. There are 2 main types of price indexes; CPI and RPI.

The Consumer Price Index (CPI) is a price index used by the government to set its inflation targets since 2004. The index is based on the prices of about 650 goods and services measured at different points in time. These are obtained through the Family Expenditure Survey. The information is compiled with data about the prices of goods and services in the bundle collected on a monthly basis from a sample of 7,000 households across the country. The weights (number of goods that are bought, e.g. 4 loafs of bread a week) for the items included in the index are meant to reflect the typical spending habits of consumers in the economy. These weights are adjusted each year to meet changing consumption patterns in households. The goods and services also change on a yearly basis to reflect changing consumer habits. Consumers habits change due to new fashion (e.g. in clothes and cosmetics), technology and availability.

The Retail Price Index (RPI) is an alternative measure of inflation. RPIX is the RPI excluding mortgage interest payments. The CPI replaced RPIX because it is believed to be a more appropriate indicator for evaluating policy effectiveness. CPI is also based on the same methodology as other European countries and so can be easily compared. The RPI excludes pensioner households and the highest-income households whereas CPI doesn’t. Also they both contain a different range of items.

If the index for one year is 117, then that means it now costs £117 to buy what initially cost £100 in the base year. Historically the RPI has generally been higher than the CPI, this is due to the different products.

The rate of inflation you hear on the news is usually referring to the rate of inflation over a yearly period. For example CPI inflation in the UK for December 2011 was 4.2%. This doesn't mean that prices have increased by this amount in a month (from November) but that from December 2010 to December 2011 prices have increased by 4.2%.

Causes of Inflation

There are 2 main factors that can cause inflation; too much demand in the economy or rising costs.

Demand-Pull Inflation

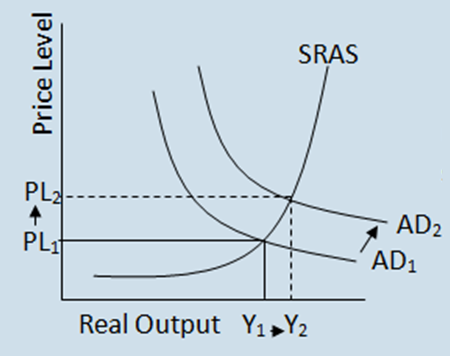

If there is an increase in aggregate demand but supply can’t match it then there will be inflation. On a graph this is shown as a rightward shift of the AD curve. Consumer spending may rise excessively. Interest rates could be low and consumers are spending large amounts on their credit cards or consumer confidence could be rising because house prices are rising. If there is an increase in aggregate demand but supply can’t match it then there will be inflation. On a graph this is shown as a rightward shift of the AD curve. Consumer spending may rise excessively. Interest rates could be low and consumers are spending large amounts on their credit cards or consumer confidence could be rising because house prices are rising.Firms may increase their spending. Perhaps they are responding to large increases in demand from consumer and need extra capacity to satisfy that demand. The government might be increasing its spending substantially or it could be cutting taxes. World demand for UK exports may be rising because of a boom in the world economy.

Cost-Push Inflation

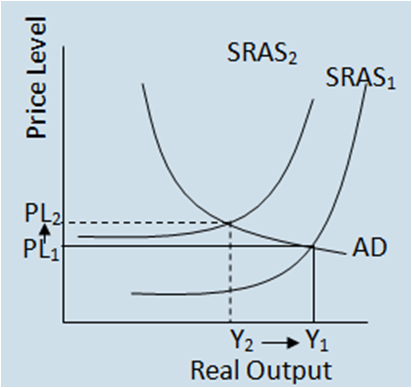

Cost-push inflation occurs because of rising costs. It is shown on a graph as a leftward shift of the SRAS curve. Wages and salaries are normally the single most important cause of increases in costs of production. Imports can rise in price. Profits can be increased by firms when they raise price to improve profit margins. Profit is considered a cost in economics and so affects the cost side rather than demand. If the product is price inelastic then it is unlikely to reduce the demand. Government can raise indirect tax rates or reduce subsidies thus increasing the price of a good. Cost-push inflation occurs because of rising costs. It is shown on a graph as a leftward shift of the SRAS curve. Wages and salaries are normally the single most important cause of increases in costs of production. Imports can rise in price. Profits can be increased by firms when they raise price to improve profit margins. Profit is considered a cost in economics and so affects the cost side rather than demand. If the product is price inelastic then it is unlikely to reduce the demand. Government can raise indirect tax rates or reduce subsidies thus increasing the price of a good.

Costs of Inflation

Shoe leather costs – If inflation is high consumers will shop around more for goods and interest-bearing accounts, this takes up consumers time, which could be more productive.

Menu costs – Shops and firms will have to change their prices often which can be expensive. Particularly for fixed capital such as vending machines and parking meters.

Psychological and Political Costs – Inflation makes people feel worse off even if their incomes rise by more than the rate of inflation. Change and revolution in the past have often accompanied periods of high inflation.

Re-distributional Costs – Inflation can redistribute income and wealth between households, firm and the state. Most people on fixed incomes will suffer; pensions, people on benefits and groups of workers unable to obtain increased wages will all suffer.

Income is distributed away from them and towards other groups (such as borrowers) and the rich. This can cause income inequality issues.

Unemployment and Growth – Some economists believe that inflation creates unemployment and lowers growth. Inflation increases costs of production and creates uncertainty. This lowers the profitability of investment and makes businessmen less willing to take the risks associated with any investment project. Lower investment results in less long term employment and growth.

There is also an effect on the balance of payments; if inflation rises faster in the UK than in other countries, and the value of the pound doesn’t change on foreign currency markers, then exports will become less competitive and imports more so. The result will be a loss of jobs in the domestic economy and lower growth.

Desirable Effects from Inflation

Inflation isn’t all bad; borrowers will benefit from inflation as the real value of the money the repay will be less than the nominal debt due to inflation. The government may also benefit as they rarely change the tax bands and inflation and rising wages push more people into higher rate tax bands. This is known as fiscal drag.

Anticipated and Unanticipated Inflation

Some inflation is unanticipated; households firms and government are unsure of future inflation rates and so when planning have to estimate the rate. It is unlikely that their estimate will be accurate so there plans will be frustrated. Conversely inflation can be anticipated. This allows households, firms and the government to build this figure into their plans.

Unanticipated inflation imposes greater costs than anticipated inflation. Economic agents can take steps to mitigate the effects of inflation through indexation. This is where the wages and taxes are increased in line with inflation. This reduces many of the costs of inflation as the lower classes still retain their percentage of income by receiving wage increases to offset the change in rising prices. Although shoe leather costs and menu costs still remain. But indexation may reduce pressure on the government for it to tackle the problem of inflation directly. Indexation eases the pain of inflation but isn’t a cure for it.

Furthermore, indexation may hinder government attempts to reduce inflation because indexation builds in further cost increases. If a government wants to get inflation down to 2% and it is at 10%, by giving workers a 10% wage increase for indexation, it wouldn’t help them reach their inflation target.

Page last updated on 20/10/13

|