- The firm must have a large share of the market in order to vary the price and prevent other firms undercutting them.

- Consumers cannot resell the product (to prevent arbitrage; a process where consumers benefiting from price discrimination sell the product to consumers that aren’t benefitting from price discrimination).

- The firm needs to know about consumers’ willingness to pay.

First Degree Price Discrimination

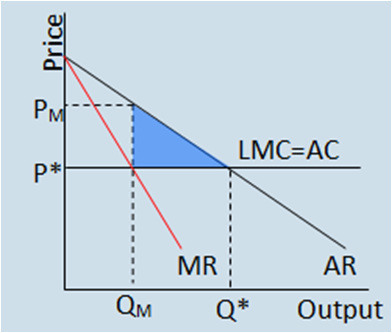

The graph to the left shows the price (P*) that would occur under perfect competition (with a quantity of Q*) and (PM) under a monopoly firm (with a quantity of QM). Under a monopoly firm there would be a deadweight loss to society shown by the blue triangle as Q*-QM output wouldn’t be produced. First Degree Price Discrimination under a monopoly can remove this deadweight loss as outlined below.

The graph to the left shows the price (P*) that would occur under perfect competition (with a quantity of Q*) and (PM) under a monopoly firm (with a quantity of QM). Under a monopoly firm there would be a deadweight loss to society shown by the blue triangle as Q*-QM output wouldn’t be produced. First Degree Price Discrimination under a monopoly can remove this deadweight loss as outlined below.If the monopolist where to charge each individual consumer a different price reflecting their price elasticity then it would be able to charge each consumer their exact willingness to pay. In effect the marginal revenue curve now equals the average revenue (D1) curve as each consumer is being charged what they are willing to pay. No consumer gains any surplus; this is captured as monopolist profit. However Q* goods are now produced and therefore there is no welfare loss. Total welfare is the same as if the market were perfectly competitive (because we don’t care which member of society has the gain as long as it is captured) but greater than if there was no price discrimination under a monopoly market. There is now a redistribution from consumers to the monopoly as the monopoly makes larger profits.

3rd

Degree Price Discrimination

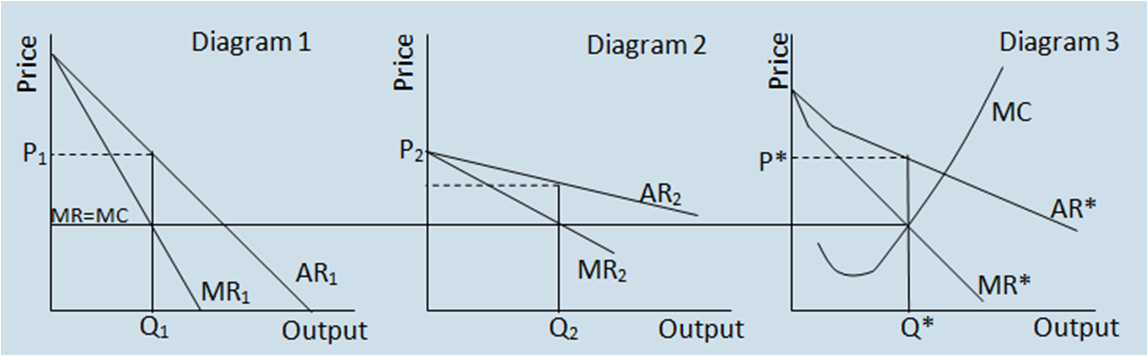

Firms would undertake price discrimination in order to increase profits by exploiting and absorbing consumer’s surplus. Consumers with a more inelastic demand can be charged a higher price than consumers that are elastic in demand. This can be shown from the 3rd degree multimarket diagram.

The 3 diagrams show the different consumer groups with their variant demand curves. Diagram 1 shows a more inelastic demand curve, diagram 2 is more elastic and diagram 3 is the overall market demand curve (aggregating the demand of the inelastic and elastic consumers) but we can see the varying elasticities on this. The firm maximises profits at MR=MC (diagram 3) and hence Q* is produced. In diagram 2 the marginal cost line intersects the MR2 curve at Q2 and therefore the price would be P2. On diagram 1 the marginal cost curve intersects the marginal revenue curve at Q1 and hence a price of P1 is charged. P1 is greater than P* (PI > P*) as diagram 1 shows an inelastic demand curve and hence these consumers are more willing to pay than the elastic customers (of whom will face a lower price than P*). Price discrimination allows the firm to gain more revenue from any given level of output.

Welfare Concerns

Those charged the lower price may be able to increase their consumption of the good/service as they can now afford it. Usually price discrimination results in an increase in output. It results in an increase in a firm’s profits (consumer surplus is turned into producer surplus), this may seem negative, but these profits could be reinvested (creating jobs etc) and may lead to lower costs in the future (through a rightward shift of the long run average cost curve).

Also a firm may not supply a good at a single price if its average revenue curve were above its average cost curve. However by price discriminating it may be able to increase revenue and thus produce.

Page last updated on 20/10/13