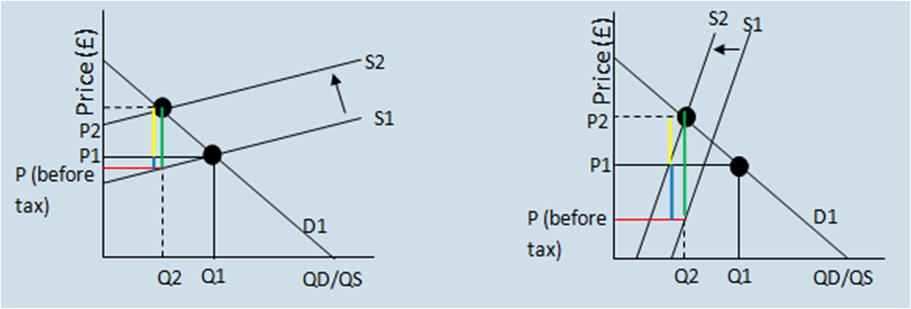

The red line represents the price before tax, the green line

represents the whole tax, the blue line represents the absorbed tax and the

yellow line represents the tax passed onto consumers.

As we can see from the graph on the left it is price elastic

demand as the demand curve is flatter than Graph 2. As the price matters to

consumers, very little of it will be passed on as it would result in a high

drop in QD. This means the suppliers will absorb a lot of the tax.

As we can see from the graph on the right, it is price

inelastic demand as the demand curve is more horizontal than Graph 1. As the

price isn’t very sensitive, suppliers can get away with passing on a lot of the

tax to consumers.

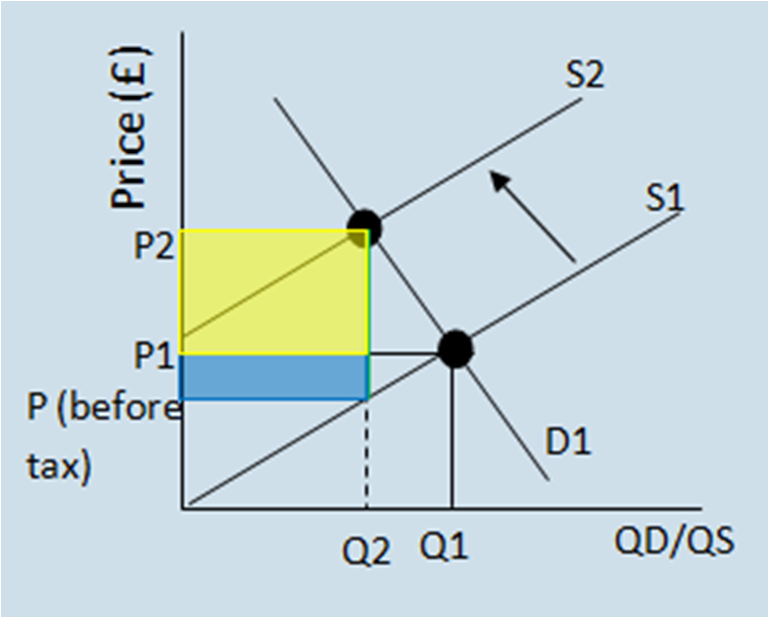

Price elasticity of supply affects the proportion of a specific tax (fixed rate) that can be absorbed by the supplier.

The red line represents the price before tax, the green line represents the whole tax, the blue line represents the absorbed tax and the yellow line represents the tax passed onto consumers.

The red line represents the price before tax, the green line represents the whole tax, the blue line represents the absorbed tax and the yellow line represents the tax passed onto consumers.

Graph 1 (left) is price elastic (supply) meaning suppliers are sensitive about the price and so pass on a lot of the tax to the consumers and don’t absorb much of it.

Conversely Graph 2 (right) is price inelastic (supply) meaning that suppliers aren’t that sensitive about the price and so absorb most of the tax.

The government revenue would equal tax per unit multiplied by the new quantity traded (Q2). On a graph this would appear as a rectangle starting from the P (before tax) point to the P2 point. The yellow area is the proportion of government revenue paid by the consumer. The blue area is the proportion of the government revenue paid by the supplier (the blue plus yellow area equals total government revenue).

NB – If the 2 supply curves aren’t parallel then it means the tax is percentage based (ad valorem) and the curves are divergent. An example of an ad valorem tax is Value Added Tax (VAT).

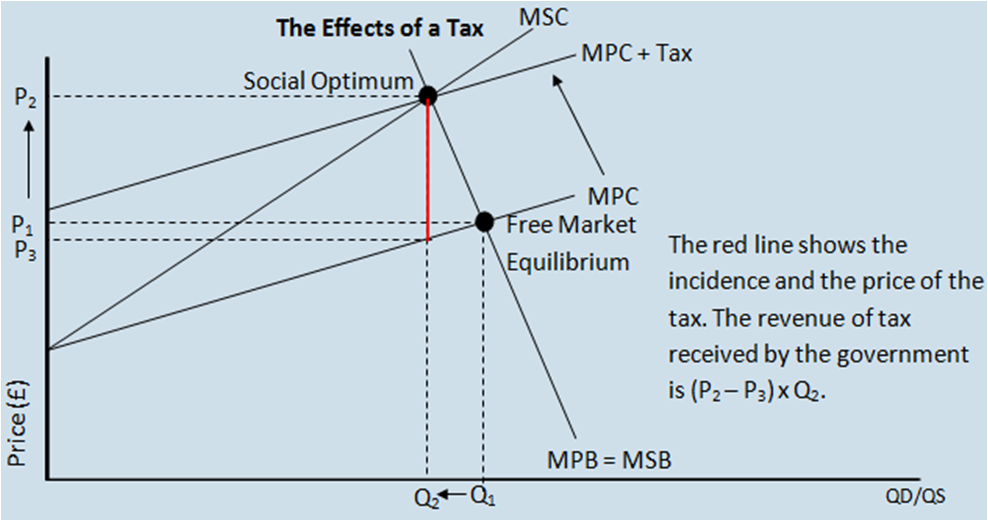

Indirect taxation can be used by the government to correct market failures. A tax would discourage consumption by increasing the price of the product (as the supplier would pass on some of the costs).This remedy would correct the market failure of externalities. A tax could be used to correct a negative production externality and would discourage the production of demerit goods.

Advantages

and Disadvantages of Taxes

Tax funds can be used to compensate victims or can be used in

other government schemes, also taxes reduce the amount produced to the social

optimum point where less of the good/service are produced therefore being more

beneficial to society.

Disadvantages of taxes are that firms may relocate to other

countries with less stringent taxes, if the demand for a good or service is

price inelastic then the reduction in good/services wont be great, indirect

taxes make firms less internationally competitive, it might lead to the

development of illegal markets and also it is hard to determine what price to

tax the good or service at.