Commodities

and Agricultural Markets

Primary

Commodities

A primary commodity is the output of the primary sector of

the economy – raw materials and food (agricultural goods). Examples of raw

materials are coal, oil, gold, bauxite (used to make aluminium), tin and

copper. Agriculture, forestry and fishery output include wheat, sugar beet,

beef, bananas, coffee, timber, fish and lean hogs (pigs).

Prices in commodities are volatile and display large

fluctuations. For agricultural outputs this is because of variability in supply

caused by natural conditions and crop yields and because of price inelasticity

on both the demand side and the supply side of the market. For commodities used

in manufacturing, demand varies with the level of economic activity. Demand for

primary commodities is a derived demand. There is price inelasticity on both

sides of the market.

PES is inelastic because in the short run suppliers cannot

easily respond to a change in price. For example once the crop is planed and

growing the wheat farmer cannot immediately plan to supply more to a market in

response to a favourable change in price and vice versa with a decrease in

price. The same goes for raw goods such as oil, it takes time and effort to

discover new oil fields and so supply can’t immediately be increased.

However in the long run supply will be elastic, for example

if the price of wheat has increased, the farmer can’t do anything this

season/year but can plan to grow more the following season/year.

PED is inelastic because consumers don’t always demand twice

as many primary commodities just because of a fall in food prices. For example

if the price of bread falls (a fall in the price of wheat) it doesn’t mean

people will buy twice as much, because they won’t consume twice as much. A lack

of substitutes for some primary commodities also makes demand inelastic for

example oil. Conversely if there are more substitutes for a primary commodity,

for example Brazilian coffee or Kenyan coffee, then PED will be more elastic.  From

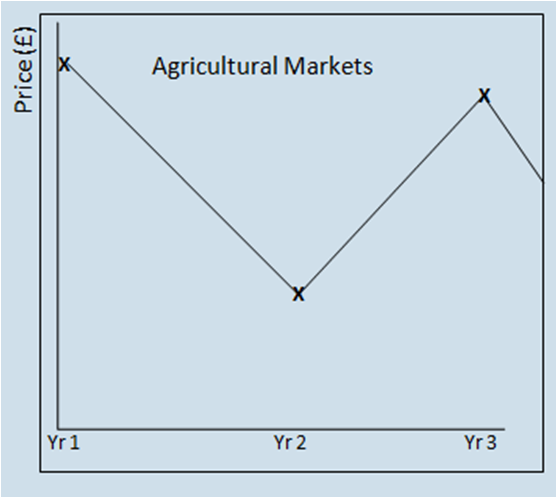

the graph below we can see the price change in a commodity such as wheat. In

the first year, the price is high and so farmer’s plan to supply a higher

quantity of wheat in year 2. However in year 2 the price falls due to this

supply increase and so the farmer will plant less in the following year. This cycle is perpetual. From

the graph below we can see the price change in a commodity such as wheat. In

the first year, the price is high and so farmer’s plan to supply a higher

quantity of wheat in year 2. However in year 2 the price falls due to this

supply increase and so the farmer will plant less in the following year. This cycle is perpetual.

These volatile prices are bad for both the consumer and the

supplier. For the consumer they don’t know how much goods are going to cost

when they go shopping and for suppliers they don’t know what their revenues are

going to be. As they are unsure of their expected revenue and profit, suppliers

will fail to invest in their industry. In the long run supply is dependent on

investment.

Speculative buying severely accentuates price movements. Speculative buying is

where an investor buys a commodity (or shares) at a low price thinking it will

increase in price and so they can sell it and make a profit (a bullish

outlook). Another form of speculative buying is to buy at a high price and sell

at a low price but make a profit (a bearish outlook). Both of these methods

exaggerate price movements.

In general if there is a price inelastic demand or supply for

any good or service then shifts in supply or demand will result in a bigger

change in equilibrium price than in equilibrium quantity.

Commodities

and Market Failures

Due to this up and down perpetual movement in commodity

prices, it is considered that there is a market failure. One proposal to fix

this market failure is to establish minimum prices.

Page last updated on 20/10/13

|